Auto Insurance in and around Plano

Discover your car insurance options from State Farm

Take a drive, safely

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

Falling tree branches, collisions and fire, oh my! Even the most experienced drivers know that sometimes trouble finds you on the road. No one knows what to expect down the highway.

Discover your car insurance options from State Farm

Take a drive, safely

Get Auto Coverage You Can Trust

Terrific uninsured motor vehicle coverage, comprehensive coverage, collision coverage, and more, could be yours with a policy from State Farm. State Farm agent Matt Scaling can confirm which of those coverage options, as well as savings options like an older vehicle passive restraint safety feature discount and accident-free driving record savings, you may be eligible for!

You don't have to ride solo when you have insurance from State Farm. Contact Matt Scaling's office today for more information on which coverage fits your needs with State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Matt at (972) 378-5300 or visit our FAQ page.

Simple Insights®

Put the brakes on aggressive driving

Put the brakes on aggressive driving

Stay alert for the signs of aggressive driving in other drivers — or perhaps even road rage bubbling up in you.

Medical Payments vs liability coverage: What’s the difference?

Medical Payments vs liability coverage: What’s the difference?

What's the difference between Med Pay and liability auto insurance? Learn who's covered, when they pay and which is required vs. optional.

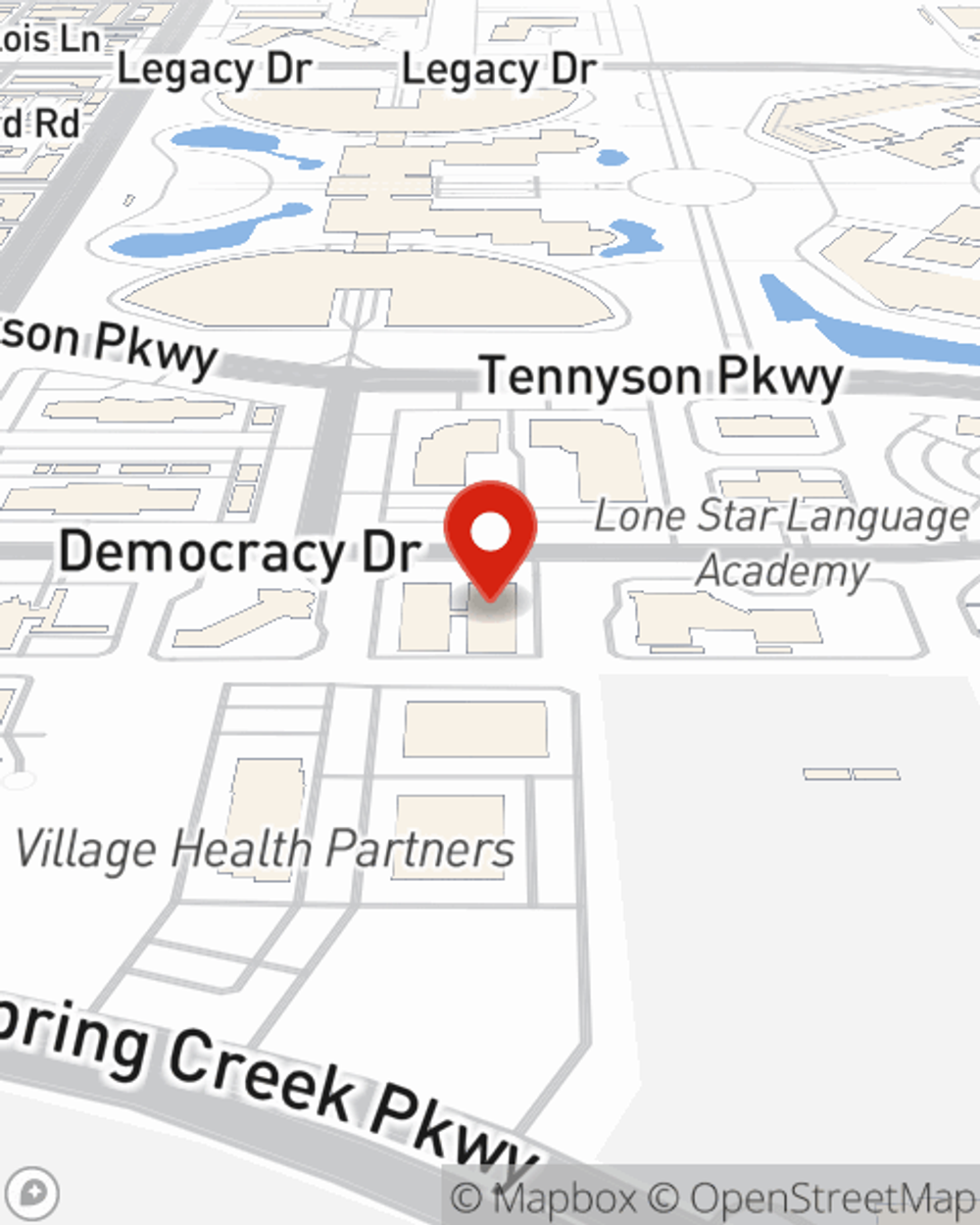

Matt Scaling

State Farm® Insurance AgentSimple Insights®

Put the brakes on aggressive driving

Put the brakes on aggressive driving

Stay alert for the signs of aggressive driving in other drivers — or perhaps even road rage bubbling up in you.

Medical Payments vs liability coverage: What’s the difference?

Medical Payments vs liability coverage: What’s the difference?

What's the difference between Med Pay and liability auto insurance? Learn who's covered, when they pay and which is required vs. optional.